In the dynamic world of human resources, the recruitment process is a critical component that can significantly impact an organization’s success. The ability to attract, select, and retain top talent is a fundamental aspect of business growth and sustainability. However, without a systematic approach to measure the effectiveness of recruitment strategies, organizations may find themselves in a perpetual cycle of trial and error. This is where recruiting metrics come into play.

Recruiting metrics are quantifiable measures used to track and analyze the efficiency and effectiveness of recruitment processes. They provide valuable insights into how well your recruitment strategies are working and where improvements can be made. By understanding these metrics, organizations can make data-driven decisions that enhance their recruitment efforts, ultimately leading to better hires and improved business performance.

Now, let’s delve into some of the most important recruitment metrics that every organization should consider:

1. Time to Fill

This metric measures the average time it takes to fill an open position from the moment it becomes vacant until an offer is accepted. A shorter time-to-fill typically indicates a more efficient recruitment process.

Time to Fill (TTF) is a crucial metric in the realm of human resources and talent acquisition that quantifies the average duration it takes to fill a vacant position within an organization. This metric is a key indicator of the efficiency and effectiveness of the recruitment process, reflecting the ability of a company to swiftly identify, attract, and secure suitable candidates for open positions.

The calculation of Time to Fill typically begins when a position becomes vacant, either due to an employee resignation, termination, retirement, or the creation of a new role. The clock continues to tick until a formal offer is extended and accepted by the selected candidate.

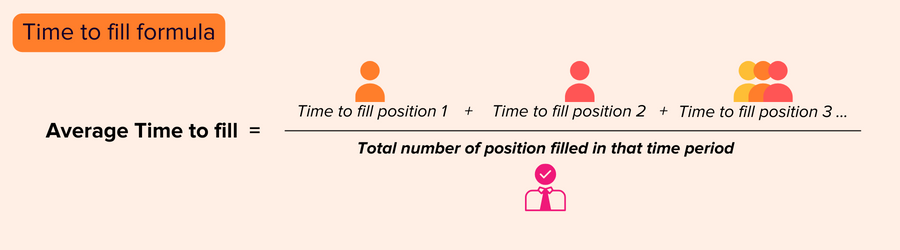

The formula for Time to Fill is:

2. Quality of Hire

Quality of Hire (QoH) is a comprehensive metric in the realm of human resources and recruitment that seeks to assess the effectiveness and impact of new hires within an organization. Unlike traditional recruitment metrics that often revolve around the efficiency of the hiring process, such as time-to-fill or cost-per-hire, Quality of Hire is more concerned with the long-term success and value that employees bring to the organization.

Key components and considerations related to the Quality of Hire metric include:

Performance Evaluation:

QoH involves evaluating the actual performance of new hires once they are onboarded. This assessment typically includes a review of their job performance, achievement of goals, and overall contribution to the team and organization.

Tenure:

The metric also takes into account the tenure of new hires, measuring how long they stay with the company. Longer tenure can be an indicator of a successful hire, especially if the employee continues to deliver value over an extended period.

Alignment with Organizational Goals:

QoH considers the extent to which new hires align with the goals and values of the organization. Employees who understand and contribute to the organizational mission are likely to be considered high-quality hires.

Cultural Fit:

Cultural fit is an essential aspect of QoH. It assesses how well new hires integrate into the company culture and work well with their colleagues. A good cultural fit often leads to higher job satisfaction and performance.

Skill and Competency Development:

Quality of Hire also examines whether new hires exhibit a willingness and ability to develop new skills and competencies over time. This is crucial for adapting to the evolving needs of the organization.

Managerial Satisfaction:

The satisfaction of managers and supervisors with the performance of their newly hired team members is another element considered in QoH. Positive feedback from managers is an indicator of a successful hire.

Employee Engagement and Retention:

QoH is linked to employee engagement and retention. High-quality hires are likely to be more engaged in their work, leading to increased job satisfaction and a lower likelihood of turnover.

Customer Satisfaction:

In certain roles, the impact of a new hire on customer satisfaction may be an important factor in assessing quality. For customer-facing positions, the ability to positively influence customer experiences is a valuable aspect of QoH.

Continuous Improvement:

Organizations that prioritize QoH often use the insights gained to refine their recruitment strategies continuously. This includes adjusting sourcing channels, interview processes, and onboarding programs to enhance the likelihood of making high-quality hires.

3. Cost per Hire

Cost per Hire (CPH) is a key metric in recruitment and human resources that measures the average cost incurred by an organization to hire a new employee. This metric helps businesses assess the efficiency and effectiveness of their recruitment processes, providing insights into the financial investment required to bring in new talent.

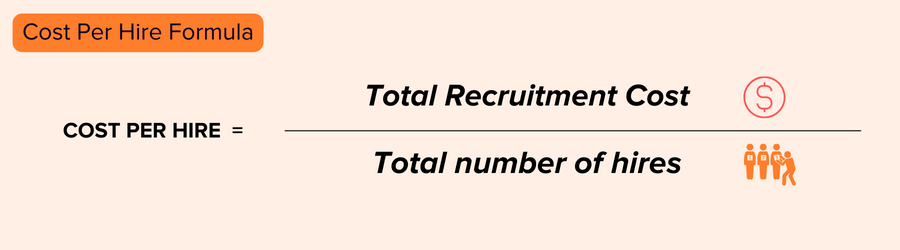

The formula for calculating Cost per Hire is typically:

Here’s a breakdown of the key components:

Total Recruitment Costs:

This includes all expenses associated with the recruitment process. Common elements include advertising costs, agency fees, job fairs, travel expenses for interviews, background checks, pre-employment assessments, and any other costs directly tied to attracting, evaluating, and hiring candidates.

Number of Hires:

This is the total count of new employees hired during a specific period, whether it’s a month, quarter, or year.

The Cost per Hire metric is valuable for several reasons:

Financial Efficiency:

It helps organizations understand the financial investment required to bring in new talent. This information is crucial for budgeting and optimizing recruitment processes.

Process Improvement:

By analyzing the components of the cost per hire, organizations can identify areas where costs can be reduced or processes can be streamlined. For example, if advertising costs are high, the company might explore more cost-effective ways to reach potential candidates.

Benchmarking:

Comparing the cost per hire with industry benchmarks or the organization’s historical data provides insights into how well the recruitment process is performing relative to others or its own past performance.

ROI Evaluation:

Understanding the cost per hire allows organizations to evaluate the return on investment (ROI) for their recruitment efforts. This is especially important for justifying recruitment budgets and demonstrating the value of the hiring process.

Strategic Planning:

Cost per hire data can inform strategic decisions about the sourcing of candidates, the use of recruitment channels, and the overall recruitment strategy. It helps in making informed decisions about where to allocate resources for the most effective results.

However, it’s important to note that while cost is a critical factor, organizations should also consider the quality of hires and time-to-fill metrics alongside cost per hire for a more comprehensive evaluation of their recruitment processes.

4. Source of Hire

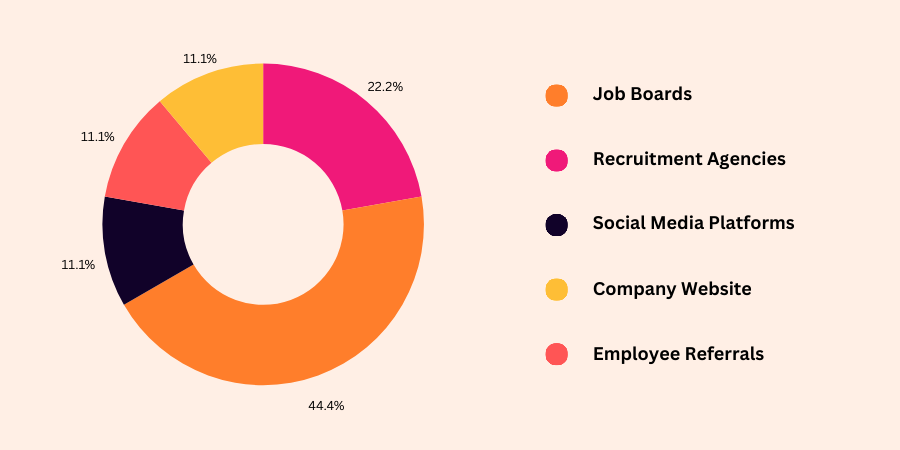

The Source of Hire metric is a key performance indicator (KPI) used in recruitment to track and analyze where successful job candidates originated from during the hiring process. This metric helps organizations understand and evaluate the effectiveness of different recruitment channels, allowing them to allocate resources more efficiently and optimize their hiring strategies.

Here’s a breakdown of how the Source of Hire metric works:

Definition:

Source of Hire refers to the specific channels or methods through which candidates discover and apply for job opportunities within a company.

Data Collection:

Recruitment teams collect data on the sources from which successful hires have come. Common sources include job boards, company career websites, employee referrals, social media platforms, recruitment agencies, and direct applications.

Tracking:

Each candidate’s source is tracked and recorded at various stages of the recruitment process. The tracking typically starts from the initial application or resume submission and continues through the interview stages, ultimately leading to a job offer and acceptance.

Analysis:

The collected data is analyzed to identify trends and patterns related to successful hires. This analysis helps organizations determine which recruitment sources are most effective in attracting qualified candidates.

Decision-Making:

Based on the analysis, recruitment teams can make informed decisions about where to focus their efforts and allocate resources. For example, if a significant number of successful hires are coming from employee referrals, the company may decide to invest more in employee referral programs.

Optimization:

Continuous monitoring and analysis of the “Source of Hire” metric allow organizations to optimize their recruitment strategies over time. They can refine their approach to specific channels, discontinue less effective sources, and experiment with new methods to attract top talent.

Performance Metrics:

The metric is often accompanied by other performance indicators, such as cost per hire, time to fill a position, and quality of hire. Combining these metrics provides a comprehensive view of the efficiency and effectiveness of the recruitment process.

By understanding where successful hires are coming from, organizations can tailor their recruitment efforts to focus on the most productive channels. This not only helps in cost savings but also contributes to building a more effective and sustainable talent acquisition strategy.

5. Applicant to Interview Ratio

The Applicant to Interview Ratio is a recruitment metric that measures the number of job applicants who progress to the interview stage in a hiring process. This metric provides insights into the efficiency and effectiveness of a company’s recruiting efforts. It helps HR professionals and hiring managers assess the quality of the candidate pool and the screening process.

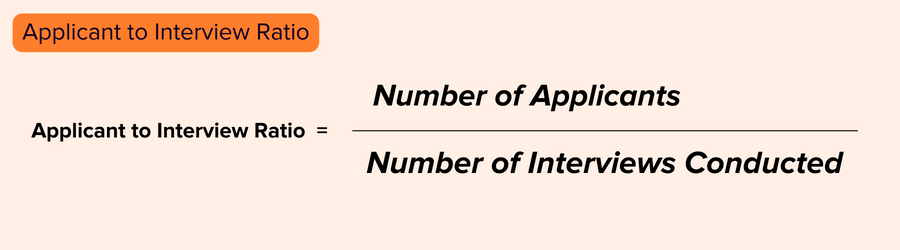

Here’s how to calculate the Applicant to Interview Ratio:

A higher ratio indicates that a larger proportion of applicants are advancing to the interview stage, suggesting a less selective screening process. On the other hand, a lower ratio suggests a more rigorous screening process where only a small percentage of applicants make it to the interview stage.

Key points to consider about the Applicant to Interview Ratio:

Recruitment Efficiency:

A low ratio may suggest that the initial screening process is effective in filtering out less qualified candidates. However, if the ratio is too low, it might indicate that the screening criteria are too strict, potentially causing the organization to miss out on potential talent.

Quality of Applicants:

A high ratio could mean that the job posting is attracting a large number of unqualified applicants. In such cases, recruiters may need to refine their job descriptions to better communicate the requirements and expectations for the role.

Time and Resource Management:

Monitoring the Applicant to Interview Ratio can help organizations manage their time and resources more effectively. If too many applicants are advancing to the interview stage, it may lead to a strain on interviewers’ time and resources. Conversely, if too few applicants are progressing, it may signal a need to broaden the candidate pool.

Continuous Improvement:

Regularly tracking this metric enables organizations to assess the effectiveness of their recruitment strategies and make adjustments as needed. By analyzing the ratio over time, recruiters can identify trends, refine their processes, and improve the overall quality of hires.

6. Offer Acceptance Rate

The Offer Acceptance Rate is a metric used in recruitment to measure the percentage of job offers extended by a company that are ultimately accepted by candidates. It is a key indicator of the effectiveness of the recruitment process and can provide insights into the attractiveness of the company to potential hires, the alignment of job offerings with candidate expectations, and the overall competitiveness of the company in the job market.

Here’s a breakdown of the components and significance of the Offer Acceptance Rate:

- Calculation:

Offer Acceptance Rate = (Number of Offers Accepted / Number of Offers Extended) * 100

- Components:

Number of Offers Extended: This refers to the total number of job offers that the company has made to candidates within a specific time frame.

Number of Offers Accepted: This represents the count of offers that candidates have agreed to and formally accepted.

- Significance:

Recruitment Process Effectiveness: A high Offer Acceptance Rate often indicates an efficient and effective recruitment process. If a significant percentage of candidates accept job offers, it suggests that the company is successful in identifying and attracting suitable candidates.

Candidate Experience: A low Offer Acceptance Rate may indicate potential issues with the candidate experience, such as misalignment between candidate expectations and the actual job, dissatisfaction with the recruitment process, or concerns about the company’s culture and values.

Competitiveness: In a competitive job market, a lower Offer Acceptance Rate could signify challenges in attracting top talent. It may prompt the company to review and improve its compensation packages, benefits, or other factors that influence candidate decision-making.

Quality of Hires: While a high Offer Acceptance Rate is generally positive, it is essential to consider the quality of hires. The focus should be on attracting candidates who are not only willing to accept the offer but also contribute to the organization’s success in the long run.

- Benchmarking:

Comparing the Offer Acceptance Rate to industry benchmarks or the company’s historical data can provide additional context. Understanding how the company’s rate compares to others in the industry helps identify areas for improvement or validation of successful recruitment strategies.

- Continuous Improvement:

Tracking the Offer Acceptance Rate over time allows recruiters and HR professionals to assess the impact of changes in the recruitment process and make data-driven adjustments for continuous improvement.

7. Employee Retention Rate

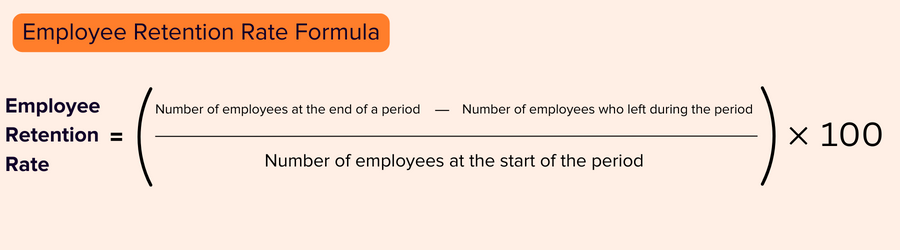

Employee Retention Rate is a key metric used in recruitment and human resources to assess the ability of an organization to retain its employees over a specific period. It is an important indicator of the company’s success in creating a positive work environment and retaining valuable talent. The formula for calculating the Employee Retention Rate is:

Here’s a breakdown of the key elements:

- Number of Employees at the End of a Period:

This represents the total headcount of employees at the conclusion of a specific timeframe. It includes both new hires and existing employees.

- Number of Employees who Left During the Period:

This includes the count of employees who voluntarily resigned, retired, or were terminated during the same timeframe.

- Number of Employees at the Start of the Period:

This is the total number of employees at the beginning of the specified period.

The resulting percentage gives insight into the organization’s ability to retain its workforce. A higher Employee Retention Rate is generally considered positive, as it indicates that the company is successful in keeping employees engaged, satisfied, and motivated to stay.

Key considerations and interpretations:

Benchmarking:

Companies often compare their Employee Retention Rate with industry benchmarks or historical data to evaluate their performance relative to others or their own past records.

High Retention Rates:

A high retention rate typically signifies a healthy work environment, good leadership, effective employee engagement programs, and overall job satisfaction.

Low Retention Rates:

A low retention rate may signal issues such as poor workplace culture, inadequate career development opportunities, or unsatisfactory employee experiences. It may prompt organizations to assess and address these areas to improve retention.

Cost Implications:

High turnover can be costly due to recruitment expenses, training costs, and productivity loss during the onboarding period. Therefore, a focus on improving retention can also have financial benefits for the organization.

Continuous Monitoring:

Employee Retention Rate is a dynamic metric that needs continuous monitoring. Regularly assessing and addressing factors influencing turnover is essential for maintaining a healthy and stable workforce.

In summary, the Employee Retention Rate is a valuable metric that provides insights into the effectiveness of an organization’s employee retention strategies. Monitoring and analyzing this metric can help businesses make informed decisions to create a more attractive and supportive work environment, ultimately contributing to long-term success.

8. Candidate Experience

Candidate Experience is a crucial metric in the field of recruitment, measuring how candidates perceive and interact with an organization’s hiring process. It focuses on the overall journey a candidate goes through, from the initial job application to the final stages of the hiring process or even beyond. A positive candidate experience is essential for attracting top talent, building a strong employer brand, and maintaining a positive reputation in the job market.

Key elements and considerations related to the Candidate Experience metric include:

Application Process:

This involves evaluating how user-friendly and streamlined the job application process is. A lengthy or complex application process can deter potential candidates and negatively impact their experience.

Communication:

Timely and transparent communication is crucial. Candidates appreciate regular updates on their application status, and clear communication about the next steps in the hiring process.

Interview Process:

The interview experience greatly influences a candidate’s perception of the company. This includes the scheduling process, the behavior of interviewers, and the overall organization of the interviews.

Feedback:

Constructive and timely feedback, whether a candidate is successful or not, is vital. It helps candidates understand where they stand, provides closure, and contributes to a positive overall experience.

Technology and Tools:

The use of technology, such as applicant tracking systems (ATS), virtual interviews, and online assessments, plays a role in the candidate experience. Easy-to-use and efficient tools enhance the overall process.

Employer Brand:

The candidate experience significantly contributes to the employer brand. A positive experience encourages candidates to speak favorably about the organization, both online and offline, which can attract more high-quality talent.

Onboarding Process:

While not strictly part of the recruitment process, the onboarding experience is crucial to a candidate’s overall journey. A smooth transition into the organization positively impacts a new employee’s engagement and retention.

Candidate Surveys:

Many organizations use candidate surveys to gather feedback on the recruitment process. This direct input helps identify areas for improvement and provides insights into what candidates value in their experience.

Candidate Respect and Dignity:

Treating candidates with respect and dignity throughout the process is fundamental. A poor candidate experience can lead to negative reviews, discouraging others from applying and potentially impacting the organization’s reputation.

By monitoring and improving the Candidate Experience metric, organizations can enhance their attractiveness to top talent, reduce time-to-hire, and positively influence their employer brand in the competitive job market. It is an integral aspect of creating a positive and inclusive workplace culture.

In conclusion, recruiting metrics are not just numbers; they are strategic tools that can significantly enhance an organization’s recruitment process. They provide a clear picture of what’s working and what’s not, enabling organizations to make informed decisions and implement effective strategies. By focusing on these key metrics, organizations can optimize their recruitment efforts, attract top talent, and ultimately drive business success. Remember, in the realm of recruitment, what gets measured gets improved.